why is aclu not tax deductible

ACLU monies fund our legislative lobbyingimportant work that cannot be supported by tax-deductible funds. Gifts to the ACLU allow us the greatest flexibility in our work.

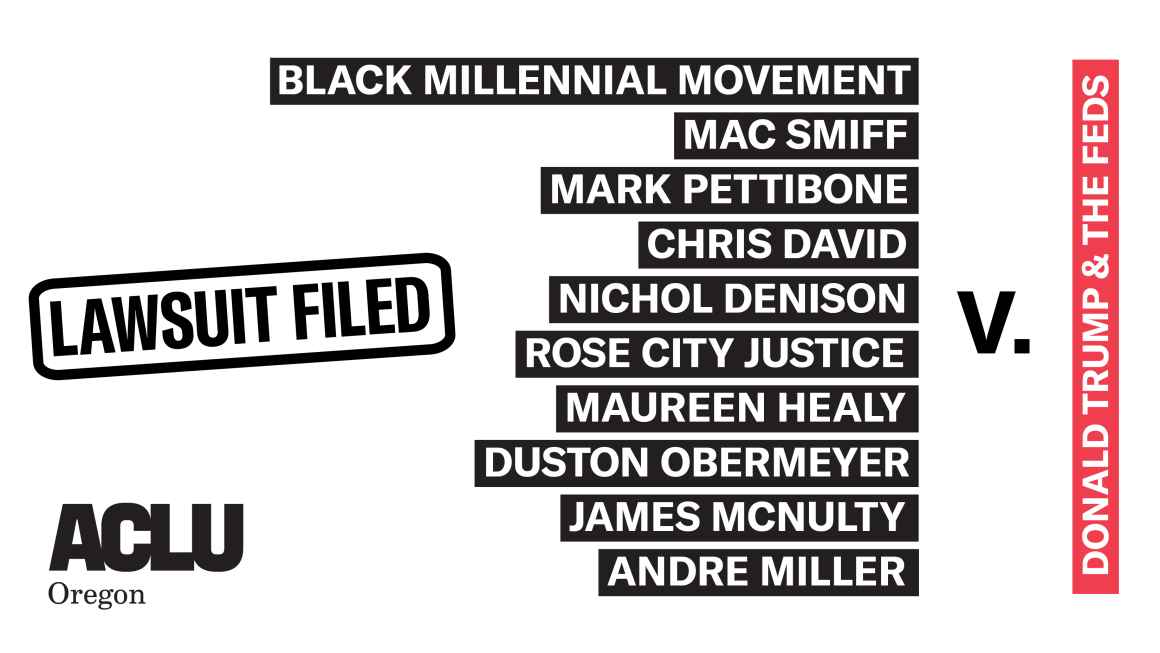

Portland Veterans Abducted Protester Black Activists Sue Trump In Aclu Lawsuit Aclu Of Oregon

This is because donations in support of legislative advocacy supporting specific bills that enhance civil liberties protections or opposing bills that seek to erode them are not tax deductible.

. Answer 1 of 4. The ACLU Foundation is a 501c3 nonprofit which means donations made to it are tax deductible. The american civil liberties union foundation aclu foundation is a 501 c 3 Why isnt aclu tax deductible.

The ACLU is a 501c 4 nonprofit corporation but gifts to it are not tax-deductible. ACLU monies fund our legislative lobbying--important work that cannot be supported by tax-deductible funds. The American Civil Liberties Union ACLU is a 501 c 4 a tax-exempt social welfare organization that engages in political andor lobbying efforts to further its mission which means donations are treated as membership fees and are therefore not tax deductible.

Make your tax-deductible gift today and help us fight alongside people whose rights are in severe jeopardy. Making a gift to the ACLU via a wire transfer allows you to have an immediate impact on the fight for civil liberties. It is the membership organization and you have to be a member to get your trusty ACLU card.

It is the membership organization and you have to be a member to get your trusty ACLU card. Gifts to the ACLU Foundation are fully tax-deductible to the donor. It is the membership organization and you have to be a member to get your trusty ACLU card.

The ACLU is a 501c 4 nonprofit corporation but gifts to it are not tax-deductible. ACLU monies fund our legislative lobbyingimportant work that cannot be supported by tax-deductible funds. As an organization that is eligible to receive contributions that are tax-deductible by the contributor federal law limits the extent to which the ACLU Foundations may engage in lobbying activities.

It is the membership organization and you have to be a member to get your trusty ACLU card. Donations to the ACLU are not tax-deductible because the organization engages in legislative lobbying. The ACLU is actually two very closely associated institutions the American Civil Liberties Union and the ACLU Foundation.

The main ACLU is a 501c4 which means donations made to it are not tax deductiblethough. Is the ACLU an organization that falls under charitable donations. ACLU monies fund our legislative lobbyingimportant work that cannot be supported by tax-deductible funds.

Membership dues and other gifts to the american civil liberties union are not tax deductible. These organizations are not considered to be charitable organizations under the regulations - that section of the Code is 501c3 - and therefore cont. Gifts to the ACLU Foundation on the other hand are deductible because that arm of the organization engages solely in legal representation and communications efforts.

The ACLU is a 501 c 4 nonprofit corporation but gifts to it are not tax-deductible. Donations to the ACLU are not tax-deductible because the organization engages in legislative lobbying. The ACLU is a 501 c 4 nonprofit corporation but gifts to it are not tax-deductible.

They support our effective citizen-based. Thank you for your interest in contributing to The Sierra Club Rochester Area GroupYour gift will help support our efforts to protect our wildlands and wildlife keep our air and water free from pollution and promote a clean energy futureNote. The American Civil Liberties Union ACLU is a 501 c 4 a tax.

It is the membership organization and you have to be a member to get your trusty ACLU card. Why is ACLU not deductible. Donations to the ACLU are not tax deductible while donations the the ACLU Foundation are.

The Wikimedia Foundation which operates Wikipedia is a 501c3 non-profit organization so US filers can deduct those donations. They also enable us to advocate and lobby in legislatures at the. About Issues Our work News Take action Shop Donate.

For more details please email us. Donations to the ACLU are not tax-deductible. You can read all about it on this page of the ACLUs website.

ACLU President Susan Herman joins At Liberty to discuss the organizations historic unanimous vote on impeachment. Gifts to the ACLU Foundation on the other hand are deductible because that arm of the organization engages solely in legal representation and communications efforts. Back to News Commentary Why the ACLU Called for Trumps Impeachment.

Other countries will have different rules though so if you arent filing a US tax return then you should consult a. Contributions gifts and dues to the Sierra Club Rochester Area Group are not tax-deductible. Therefore most of the lobbying activity done by the ACLU and discussed in this Web site is done by the American Civil Liberties Union.

While not tax deductible they advance our extensive litigation communications and public education programs. Answer 1 of 6. It is the membership organization and you have to be a member to get your trusty ACLU card.

Gifts to the ACLUs Guardian of Liberty monthly giving program are not tax deductible. Gifts to the aclu foundation on the other hand are deductible because that arm of the organization engages solely in legal representation and communications efforts. As other answers have noted the ACLU proper is a tax-exempt organization per section 501c4 of the Internal Revenue Code.

It is the membership organization and you have to be a member to get your trusty ACLU card. The ACLU is a 501 c 4 nonprofit corporation but gifts to it are not tax-deductible. Why is donating to the ACLU not tax deductible.

The ACLU is a 501c 4 nonprofit corporation but gifts to it are not tax-deductible. You can read all about it on this page of the ACLUs website. The American Civil Liberties Union Foundation ACLU Foundation is a 501 c 3 a tax-exempt.

ACLU monies fund our legislative lobbyingimportant work that cannot be supported by tax-deductible funds.

Donate To The Aclu Of Florida Aclu Of Florida We Defend The Civil Rights And Civil Liberties Of All People In Florida By Working Through The Legislature The Courts And

Fuel Our 2022 Action Fund American Civil Liberties Union

Update Your Monthly Commitment To The Aclu American Civil Liberties Union

Aclu Of Colorado Home Facebook

Pin By Wan M On Politics History Current Events Global Dod In 2021 Family Separation Supportive Make A Donation

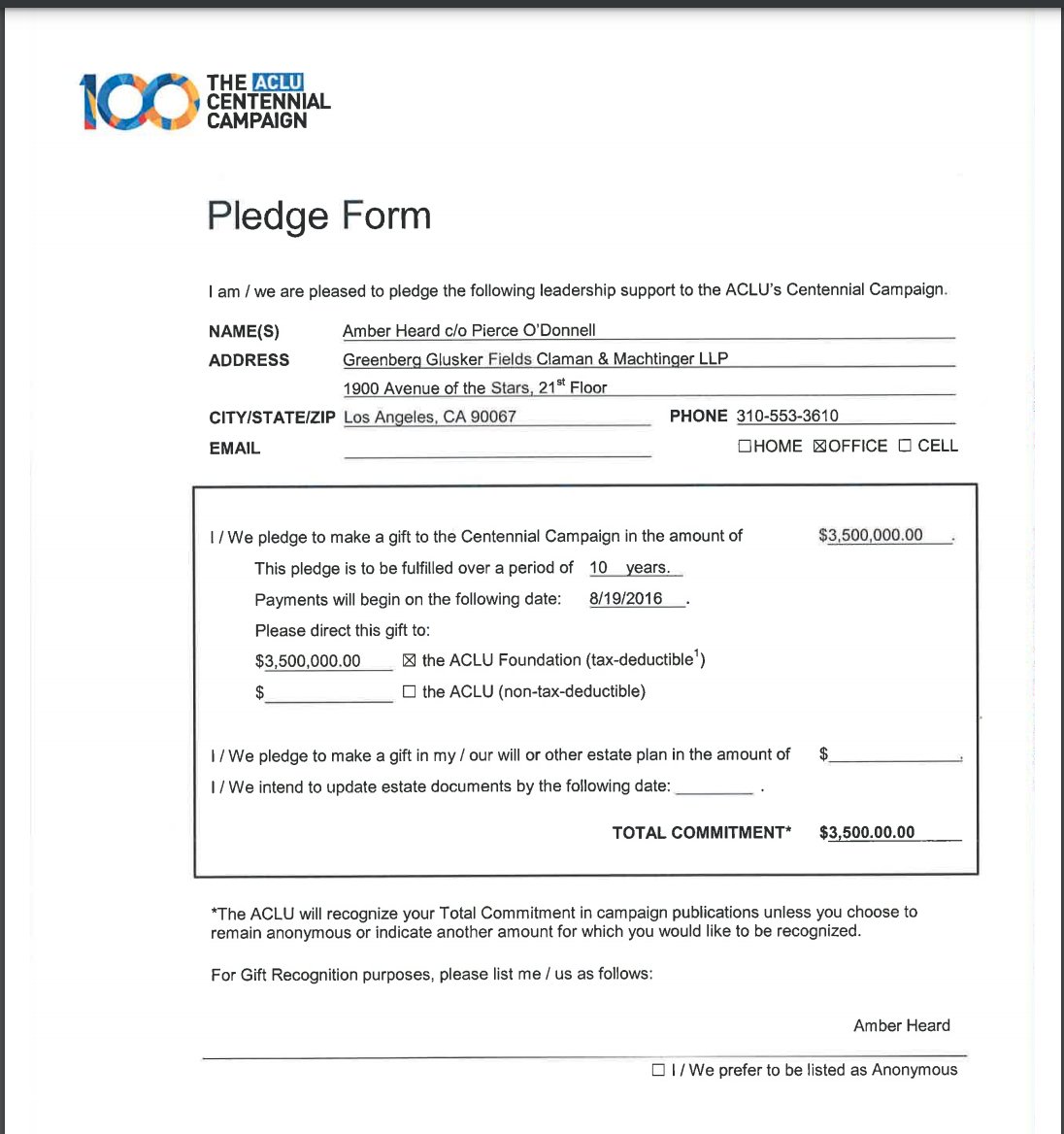

Thereallaurab S Tweet Littlethings226 Great Catch Why Would They Use Their Centential Logo Anytime Before 2019 So That Pledge Form Was Created Probably After The Subpoenas Were Issued In 2020 No Wonder

Aclu Testimony Prairie Village Ks Non Discrimination Ordinance Aclu Of Kansas

Aclu Donations How To Make A Tax Deductible Gift Money

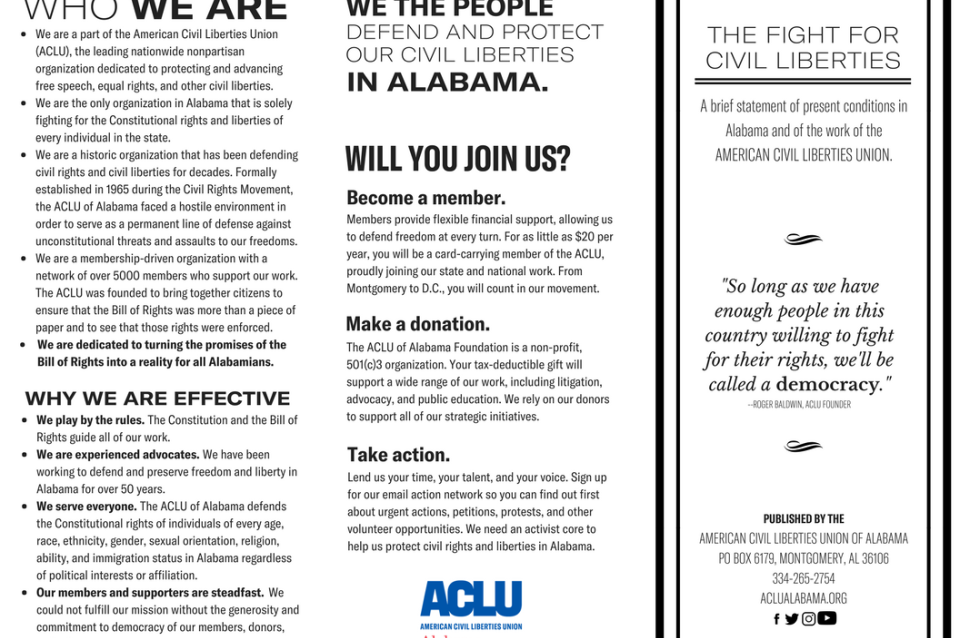

Aclu Of Alabama Quick Facts Aclu Of Alabama

Aclu Of Virginia Home Facebook

Is Our Democracy At Risk Answer Question In Flagler Volusia Aclu Essay Contest 850 In Prize Money Flaglerlive

Thereallaurab S Tweet Littlethings226 Great Catch Why Would They Use Their Centential Logo Anytime Before 2019 So That Pledge Form Was Created Probably After The Subpoenas Were Issued In 2020 No Wonder

Ford County Clerk Does Not Oppose The Aclu Of Kansas Motion To Dismiss Lawsuit Plaintiffs Score Two New Voting Stations In Dodge City Aclu Of Kansas

Inchhighpi S Tweet There S The Aclu Foundation Aclu Ah Gave To The Foundation That Accepts Donor Advised Funds Vanguard It S Tax Deductible Aclu Only Is Non Tax Deductible Ah Got 7