are 529 college savings plans tax deductible

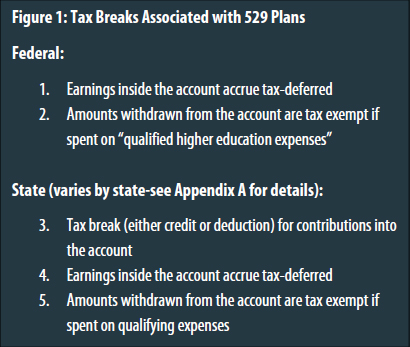

529 plans allow account owners friends and family to contribute to a college fund with after-tax income and enjoy two types of potential tax benefits. One of the benefits of paying for college out-of-pocket is the tax deduction.

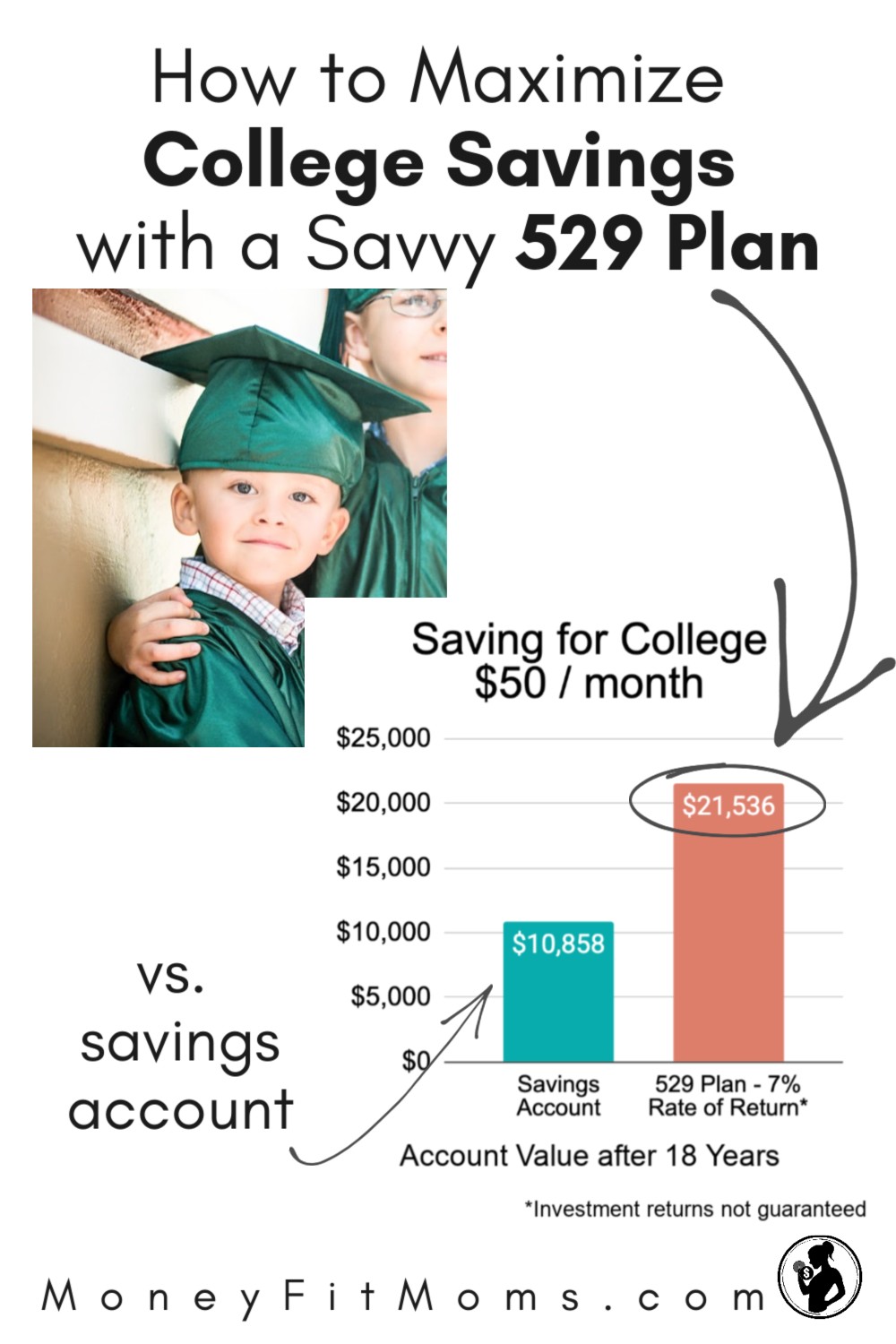

How To Maximize College Savings With A Savvy 529 Plan

Check with your 529 plan or your state to find out if youre eligible.

. Unlike traditional IRAs and 401ks 529 plan contributions are not tax deductible at the federal level. With 529 College Savings Plans you can save and accrue interest on after-tax dollars. Cannot deduct rollover contributions.

Despite the fact that contributions are not tax deductible in most cases they are generally tax deferred both for federal and state purposes. However some states may consider 529 contributions tax deductible. You can use the.

50 tax credit offered depending on income. In most of these. New Jersey Governor Phil Murphy Senate President Stephen Sweeney and Assembly Speaker Craig Coughlin agreed upon several provisions to help families and students save for college and pay off student loans including an NJ 529 state tax deduction.

Oregon 529 Plans Tax Deductible LoginAsk is here to help you access Oregon 529 Plans Tax Deductible quickly and handle each specific case you encounter. Earnings from 529 plans are not subject to federal tax and generally not subject to state tax when used for qualified education expenses such as tuition fees books as well as. One of the many benefits of saving for a childs future college education with a 529 plan is that contributions are considered gifts for tax purposes.

The Internal Revenue Code offers several tax benefits to 529 savers including the previously mentioned tax-deferred growth and tax-free. Check with your 529 plan or your state to find out if youre eligible. Each year you can deduct up to 2500 of student loan interest paid.

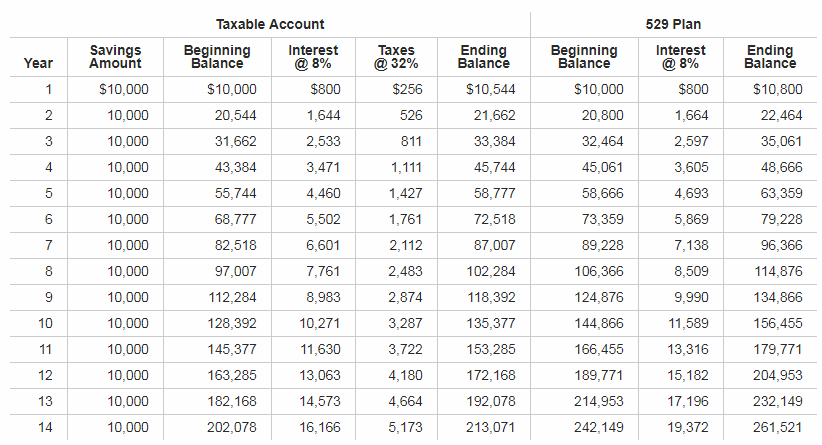

Investments in 529 plans grow tax-deferred which means you dont have to pay federal state taxes on the money you invest in them. Minnesota Deduct up to 1500 per year. Saving for college with 529 College.

Can You Get A Federal 529 Tax Deduction. 529 plans provide significant tax advantages that can free up some cash flow. College Savings Accounts Tax Deductible LoginAsk is here to help you access College Savings Accounts Tax Deductible quickly and handle each specific case you encounter.

This means you dont pay income. Are College Savings Plans Tax. A 529 plan allows you to save for.

Deduct up to 7500 for rollover contributions. The NJ 529 tax deduction is part of a comprehensive college affordability plan in the states fiscal year 2022 budget. A 529 plan allows you to save for.

Furthermore you can find the. Arkansas Deduct up to 5000 per year for in-state 529 plans or 3000 for out-of-state 529 plans. Thanks to recent legislation however you may now be able to deduct up to.

However some states may consider 529 contributions tax deductible. Kansas Deduct up to 3000 per year. The cost of higher education is going up but that shouldnt get you down.

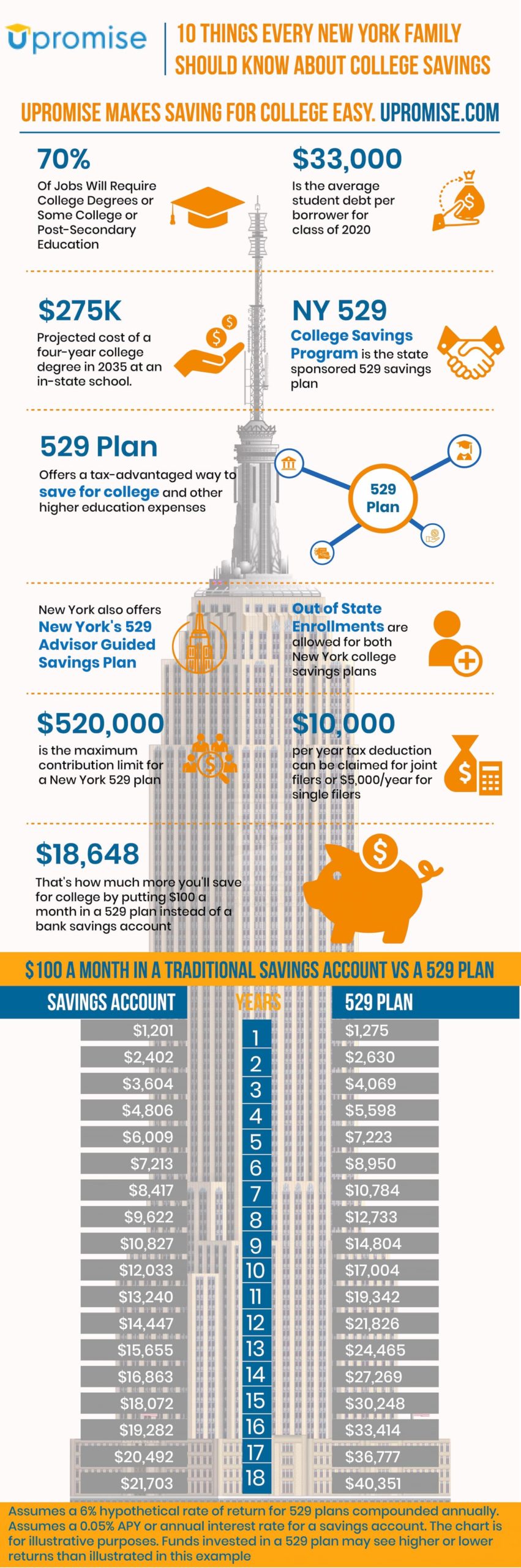

Distributions are also tax-free if used to. 7 rows Your Guide To The New York 529 Tax Deduction. 529 plan contributions may be state tax deductible Residents of over 30 states may qualify for a state income tax deduction or credit for 529 plan contributions.

Although contributions are not deductible earnings in a 529 plan grow federal tax-free and will not be taxed when the money is taken out to pay for college. Annual Gift Tax Exclusion. 15 This deduction which is also available to non-itemizers begins to phase out in 2021 for married.

How Much Are 529 Plans Tax Benefits Worth Morningstar

Tax Reform Bill Expands 529 Savings Plans

How To Gift A 529 Savings Account

Parents Do You Have The Best 529 College Savings Plan Yes You Can Choose The Washington Post

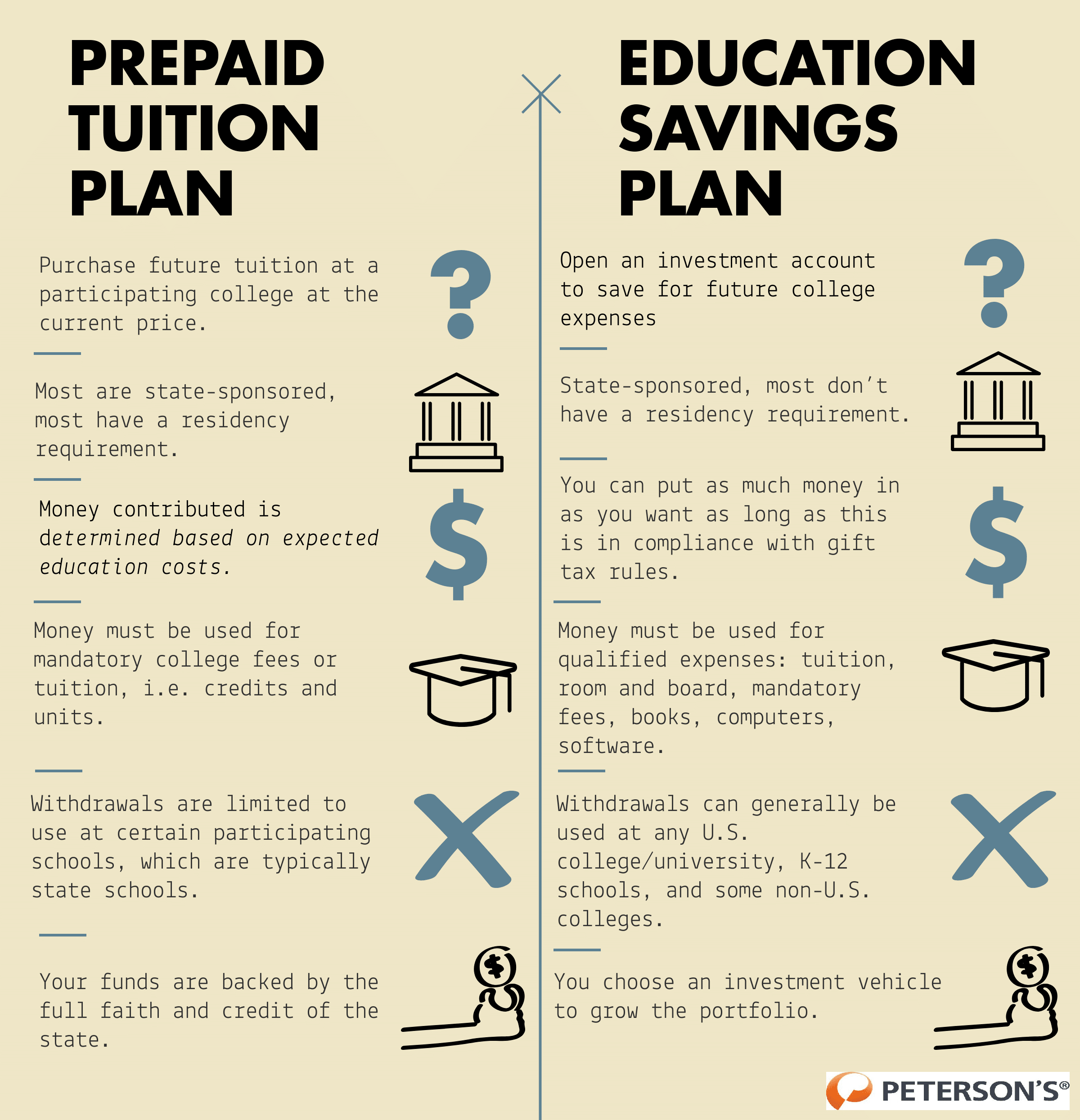

529 Plans 529 College Savings Plans What Is A 529 Plan

Choosing The Right College Savings Plan Buckingham Strategic Wealth

How Do I Choose A 529 Morningstar 529 College Savings Plan College Savings Plans Saving For College

How Much Is Your State S 529 Plan Tax Deduction Really Worth Savingforcollege Com

Can I Use A 529 Plan For K 12 Expenses Edchoice

529 College Savings Plans Wealth And Investments Rockland Trust

Benefits Of Using A 529 College Savings Plan Sofi

How Much Are 529 Plans Tax Benefits Worth Morningstar

College Savings Iowa Iowatreasurer Gov

New Jersey Provides Tax Deduction For College Savings Plan Contributions

529 Plan New York Infographic 10 Facts About Ny S 529 To Know

Iowa 529 Beyond The Basics Of Iowa S College Savings Plan Arnold Mote Wealth Management

Is There A Tax Deduction For 529 College Savings Plan

Preventing State Tax Subsidies For Private K 12 Education In The Wake Of The New Federal 529 Law Itep